Nearly all auto insurance carriers offer the option of having their clients driving habits monitored. Depending on the carrier, this can be either a device plugged into the vehicle’s on-board diagnostic port (ODB-II Port), or an App downloaded on your phone.

Introduction

Most of the big insurance carriers say that having driving data available enables them to reward good drivers with lower premiums. After all, insurance carriers are all about assessing and managing risk. Statistically, drivers who display erratic behavior on the road, are much more likely to be involved in an accident-simple as that.

Most of the big insurance carriers say that having driving data available enables them to reward good drivers with lower premiums. After all, insurance carriers are all about assessing and managing risk. Statistically, drivers who display erratic behavior on the road, are much more likely to be involved in an accident-simple as that.

Save a Life: It is also expected and studies show that when someone knows their driving is being monitored, they will likely be more aware when they get behind the wheel. As an agency owner, I have participated in safe driving programs with two of our main carriers, and I can say that I do drive better (or I’m least more aware) when I know the device is installed in my vehicle.

What Is Being Monitored?

Depending on the carrier, the following are the key criteria:

- Hard braking, hard acceleration, sudden lane changes. This category is sometimes referred to as “smoothness”.

- Speeding – enough said

- Type of road/Road conditions: Generally driving on a freeway is less risky than driving on local roads.

- Miles driven/Time of Day: The more miles driven increases risk, as does night time driving

Discounts – The Bottom Line

You can typically save anywhere between 8-10% on the initial policy issuance if you participate. Depending on the carrier, you can also save additional money when the policy renews. Carriers claim this can be 10% up to 25% or more, though many are skeptical of these figures.

Not Always Savings: Most of the carriers selling points may lead you believe that your premiums can only decrease, not increase. However, this is rarely the case, and we have seen firsthand very disappointed (or angry) clients whose rates have gone up.

Privacy Concerns

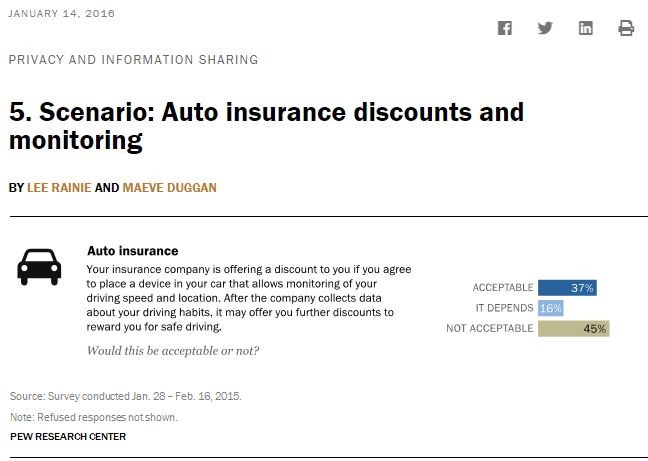

Some of us understandably have privacy concerns. One client of ours who felt like such programs were an intrusion said: “I feel like I have enough eyes on me”. It is true, we all have different perspectives and varying opinions on this based on life experiences and other factors.

My experience has been that generally, millennials and younger people would have fewer concerns about participating that would baby boomers, or those over 50 years old.

Others wonder what does the carrier do with my driving data? Is my data protected? Is my data sold to other vendors? All of these are legitimate questions. Each carrier has their own rules, and one would need to read the fine print.

See below: Pew Research Survey

Teens or Inexperienced Drivers

Some parents or guardians may appreciate having household members driving patterns being monitored. One can log into the carrier web-site and see a dashboard summarizing driving activity, and even a target of how much the policy holder is on track to save. Naturally the teen or inexperienced driver may not appreciate, or even resent this, which is understandable.

Safety is often the motivating factor for many parents/guardians. The monitoring programs can tell you trip details-where the vehicle started and ended up, how far the trip was, and much more.

We had a client whose teenager had two moving violations in a three-month period, and not surprisingly, the premiums increased upon renewal. If household members driving dashboards are periodically reviewed together, safe driving strategies can be discussed and implemented. Not a failsafe, but a good starting point. If the phone App is downloaded rather than using a device, the programs also track all trips, regardless of who is driving.

Guilty As Charged

“We gonna have to shut you down”

Upon reviewing my own driving data from the past year, I can see I have A LOT of room for improvement in my driving habits. Hard braking seems to be my Achilles heel, but I also see a number of instances of speeding (though no more than 7 mph over the speed limit), and even some hard acceleration at times.

We have seen the enemy, and he is us”

The dashboard below may or may not belong to an Independent Insurance Agent in Kaysville, UT.

See below, an excellent article from U.S. News and World Report with some great insights.

“How Do Tracking Devices Work”

https://cars.usnews.com/cars-trucks/car-insurance/how-do-those-car-insurance-tracking-devices-work

I would welcome your input and feedback about this article, as well as other insurance related topics you are interested in, or specific questions you may have.

Call for a Consultation

801-939-3210